编写一个Java程序来计算复合利息,并附带示例。复合利息计算的背后公式

未来总额 = 本金 * ( 1 + 利率 )年数)

上述公式用于计算未来总额,因为它同时包含了本金和复合利息。要获得复合利息,请使用以下公式

复合利息 = 未来总额 – 本金

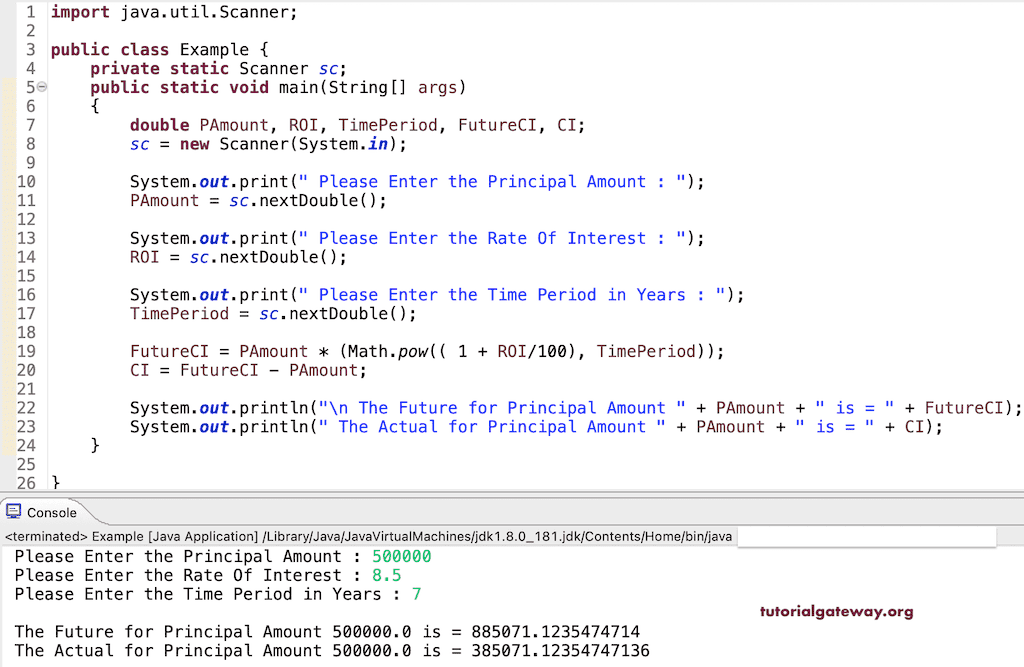

Java 复合利息计算示例程序

此程序允许用户输入本金、利率和总年数。通过使用这些值,该程序使用上述公式计算复合利息。

import java.util.Scanner;

public class Example {

private static Scanner sc;

public static void main(String[] args)

{

double PAmount, ROI, TimePeriod, FutureCI, CI;

sc = new Scanner(System.in);

System.out.print(" Please Enter the Principal Amount : ");

PAmount = sc.nextDouble();

System.out.print(" Please Enter the Rate Of Interest : ");

ROI = sc.nextDouble();

System.out.print(" Please Enter the Time Period in Years : ");

TimePeriod = sc.nextDouble();

FutureCI = PAmount * (Math.pow(( 1 + ROI/100), TimePeriod));

CI = FutureCI - PAmount;

System.out.println("\n The Future for Principal Amount " + PAmount + " is = " + FutureCI);

System.out.println(" The Actual for Principal Amount " + PAmount + " is = " + CI);

}

}

使用函数计算复合利息的程序

此程序与上面相同。但这次,我们将创建一个单独的方法来计算复合利息。

import java.util.Scanner;

public class Example {

private static Scanner sc;

public static void main(String[] args)

{

double PAmount, ROI, TimePeriod;

sc = new Scanner(System.in);

System.out.print(" Please Enter the Principal Amount : ");

PAmount = sc.nextDouble();

System.out.print(" Please Enter the ROI : ");

ROI = sc.nextDouble();

System.out.print(" Please Enter the Time Period in Years : ");

TimePeriod = sc.nextDouble();

calCmpI(PAmount, ROI, TimePeriod);

}

public static void calCmpI(double PAmount, double ROI, double TimePeriod)

{

double FutureCI, CI;

FutureCI = PAmount * (Math.pow(( 1 + ROI/100), TimePeriod));

CI = FutureCI - PAmount;

System.out.println("\n Future for " + PAmount + " is = " + FutureCI);

System.out.println(" Actual for " + PAmount + " is = " + CI);

}

}

Please Enter the Principal Amount : 1400000

Please Enter the ROI : 9.5

Please Enter the Time Period in Years : 7

Future for 1400000.0 is = 2642572.2488883743

Actual for 1400000.0 is = 1242572.2488883743